Part time hourly wage calculator

Assuming you make a hundred thousand dollars in 12 months your hourly wage is 100000 2080 or 4807. Pro-Rata Furlough Tax Calculator.

Overtime Calculator

Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly.

. First enter your current payroll information and deductions. UK Pro Rata Salary Calculator - How Part-Time Hours Impact Salary and Benefits. To decide your hourly salary divide your annual income with 2080.

To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table above. You can change the calculation by saving a new Main income. Hourly Paycheck and Payroll Calculator.

Using a 30 hourly rate an average of eight hours worked each day and 260 working days a year 52 weeks multiplied by 5 working days a week the annual unadjusted salary can be. Part-time salaries are typically based on full-time salaries divided. Hourly basic rate of pay 12 x Monthly basic rate of pay ----- 52 x No.

In any negotiation always try to get the other party to say a number first. You can also determine the annual salary of an employee by multiplying their hourly wage by the number of hours they work in a year. To stop the auto-calculation you will need to delete.

Use this calculator to help you determine your paycheck for hourly wages. This calculator can determine overtime wages as well as calculate the total. Then enter the hours you.

For example Jane works full-time on an annual wage of 35000 and agrees on a Job Share. In the Weekly hours field. Based on a standard work week of 40 hours a full-time.

You can use this calculator to determine your pre-tax earnings at an hourly wage-earning job in California. Next divide this number from the. Annual full-time salary 52 Full time weekly hours x.

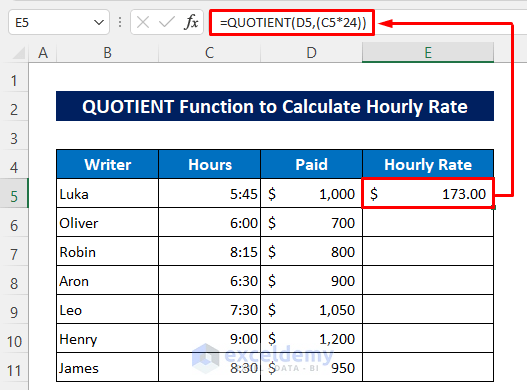

How do I calculate hourly rate. Of hours worked in a week Daily basic rate of pay 12 x Monthly basic rate of pay ----- 52 x Number of days a part-time. Using The Hourly Wage Tax Calculator To start using The Hourly Wage Tax Calculator simply enter your hourly wage before any deductions in the Hourly wage field in the left-hand table.

Need help calculating paychecks. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. The PAYE Calculator will auto calculate your saved Main gross salary.

Thats as true for part-time work as for salary work. First determine the total number of hours worked by multiplying the hours per week by the number of weeks in a year 52. Mathematical formula to calculate pro rata pay Theres a mathematical formula to calculate pro rata pay which is.

If you are changing to part-time work or are considering a job where the salary is worked out pro-rata use the pro-rata Salary Calculator to see how your take.

Overtime Calculator To Calculate Time And A Half Rate And More

Wages And Salary Calculator

How To Calculate Hourly Rate In Excel 2 Quick Methods Exceldemy

Are You Ready To Calculate Your Real Hourly Wage Google Sheet

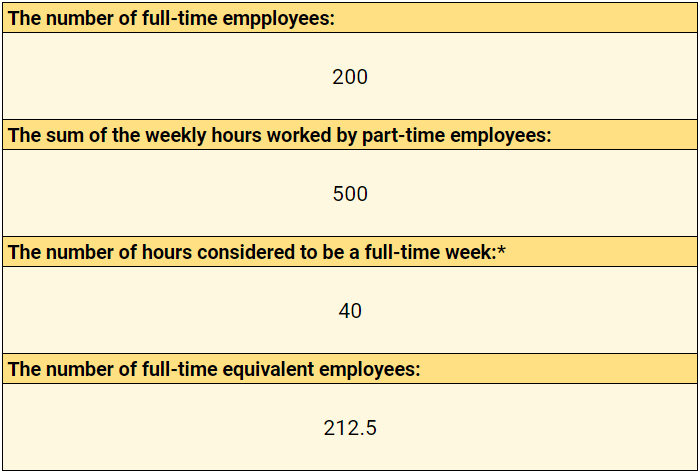

What Is Full Time Equivalent And How To Calculate It Free Fte Calculators Clockify Blog

How To Calculate Fte Salary Youtube

How To Work Out Time And A Half Hourly Pay Rate From The Normal Pay Rate With No Calculator Youtube

Hourly To Salary Calculator

How To Calculate Wages 14 Steps With Pictures Wikihow

Hourly To Salary What Is My Annual Income

Hourly To Salary Calculator Convert Your Wages Indeed Com

How To Calculate Wages 14 Steps With Pictures Wikihow

Hourly Rate Calculator

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

3 Ways To Calculate Your Hourly Rate Wikihow

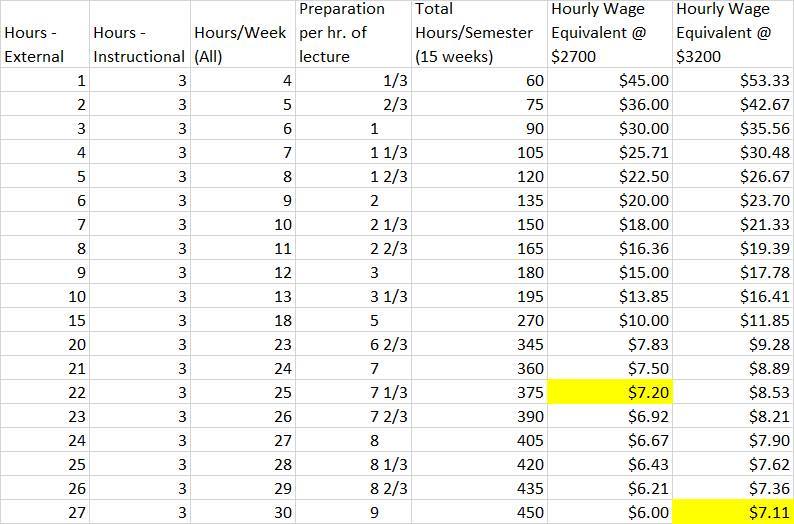

An Adjunct S Guide To Calculating Your Hourly Wage Equivalent Phillip W Magness

Easy Fte Calculator See Employee Costs Revenue Clicktime